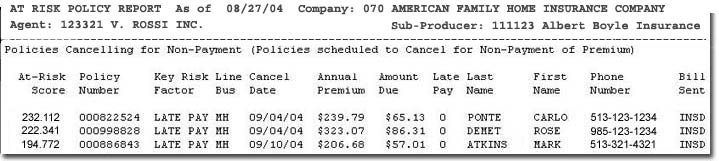

Policies Cancelling for Non-Payment

The At Risk Policy Report is a tool developed by American Modern Insurance Group to help agents retain customers whose policies may be at risk of canceling or expiring without renewing.

In addition to providing an expiration list, the At Risk Policy Report establishes an At-Risk Score, designed to prioritize the policies that are most likely to cancel. The higher the score, the more at risk the policy is for cancelling without intervention. The At Risk Score is determined by an algorithm that considers factors such as:

Number of days until or after payment due

Tenure of policy

Pay plan

Rate increases

Late payment history

Policy term

Seasonality

Expiration date

The report is updated daily to ensure you have the most current information.

A phone call, email or postcard to the policyholder may be the best chance to deliver quality customer service and hold on to valuable business.

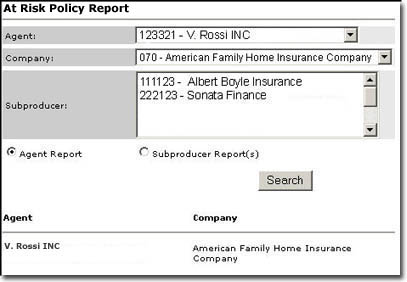

To generate an At Risk Policy Report:

Click Reports in the Other section of the modernLINK Quick Start menu.

The Reports page opens.

To determine the agencies listed, select the combination of Agent, Company and, if applicable, Subproducer(s).

Click Agent Report to see all policies without Subproducers for the Agent selected, or click Subproducer Reports to filter the list and see only the report entries for the selected Subproducer(s).

Click Search.

If the search is successful, a report listing appears at the bottom of the page. If only one result is returned, the report is opened automatically.

Click the desired report link.

The At Risk Policy Report is generated and opens in a new window.

The report is broken out into three categories:

The Policies Cancelling for Non-Payment section shows policies that are scheduled to cancel for non-payment of premium.

|

Field |

Description |

|

At-Risk Score |

The higher the score, the more likely the policy is to cancel or not renew without intervention. |

|

Policy Number |

Policy number. |

|

Key Risk Factor |

Of all the factors looked at to determine the at-risk score, this is the one that had the most impact on the score. Key Risk Factors include: # RENEWS: Number of previous renewals; fewer # of renewals gets higher risk factor. PAY PLAN: Payment plan of current policy; certain pay plans cause more risk. RATE INC: Percentage of rate increase from previous term could put policy renewal at risk. LATE PAY: Number of times Insured has paid late in current term; if he never pays late, he may be at risk. POL TERM: Current policy term; multi-year policies coming up for renewal are especially vulnerable. SEASON: Seasonal products are susceptible to lapses, especially in the off season. EXPIRING: Policy is expiring, a critical time in terms of customer retention. |

|

Line Bus |

Product Line. |

|

Cancel Date |

The date that the policy will cancel in the American Modern system. |

|

Annual Premium |

The total annual premium for the policy. |

|

Amount Due |

The premium due for the policy. |

|

Late Pay |

The number of times that the customer has paid late in the current term. |

|

Last Name |

Policyholder's last name. |

|

First Name |

Policyholder's first name. |

|

Phone Number |

Policyholder's phone number from American Modern records. |

|

Bill Sent |

Indicates where the bill is sent (Insured, Lienholder, Agent). Verify billing is correct. |

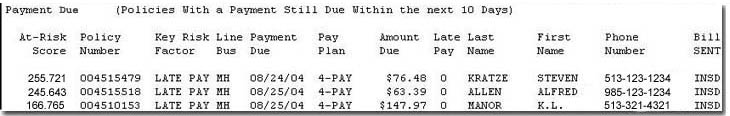

The Payment Due section shows policies that have a payment due within the next 10 days.

|

Field |

Description |

|

At-Risk Score |

The higher the score, the more likely the policy is to cancel or not renew without intervention. |

|

Policy Number |

Policy number. |

|

Key Risk Factor |

Of all the factors looked at to determine the at-risk score, this is the one that had the most impact on the score. Key Risk Factors include: # RENEWS: Number of previous renewals; fewer # of renewals gets higher risk factor. PAY PLAN: Payment plan of current policy; certain pay plans cause more risk. RATE INC: Percentage of rate increase from previous term could put policy renewal at risk. LATE PAY: Number of times Insured has paid late in current term; if he never pays late, he may be at risk. POL TERM: Current policy term; multi-year policies coming up for renewal are especially vulnerable. SEASON: Seasonal products are susceptible to lapses, especially in the off season. EXPIRING: Policy is expiring, a critical time in terms of customer retention. |

|

Line Bus |

Product Line. |

|

Payment Due |

Payment due date. |

|

Pay Plan |

Payment plan of current policy – certain pay plans cause more risk. Renewal time is a good time to switch pay plans. EFT (EZPay) saves your customer time and money. |

|

Amount Due |

The premium due for the policy. |

|

Late Pay |

The number of times that the customer has paid late in the current term. |

|

Last Name |

Policyholder's last name. |

|

First Name |

Policyholder's first name. |

|

Phone Number |

Policyholder's phone number from American Modern records. |

|

Bill Sent |

Indicates where the bill is sent (Insured, Lienholder, Agent). Verify billing is correct. |

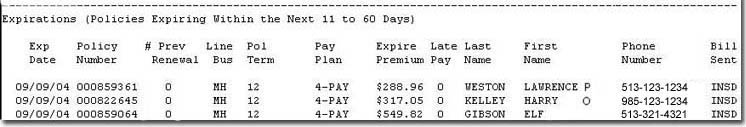

The Expirations section shows all policies due to expire within the next 11 to 60 Days. The As Of Date at the top of the report indicates when the report was pulled from the American Modern system, typically from the previous business day. It may be helpful to view individual policies via policy inquiry to get the most current status.

Expirations report information includes:

|

Field |

Description |

|

Exp Date |

Expiration date. |

|

Policy Number |

Policy number. |

|

# Prev Renewal |

Number of Previous renewals. |

|

Line Bus |

Product Line. |

|

Pol Term |

Policy Term (in months). |

|

Pay Plan |

Payment plan of current policy – certain pay plans cause more risk. |

|

Expire Premium |

The premium for the policy term just ending (not the renewal premium amount). |

|

Late Pay |

The number of times that the customer has paid late in the current term. |

|

Last Name |

Policyholder's last name. |

|

First Name |

Policyholder's first name. |

|

Phone Number |

Policyholder's phone number from American Modern records. |

|

Bill Sent |

Indicates where the bill is sent (Insured, Lienholder, Agent). Verify billing is correct. |

|

|

For best printing results, prior to printing, set your page to landscape and your left and right margins to .25 inches in the File > Page Setup dialog. |